Main Content

Investment

Real Estate Investment

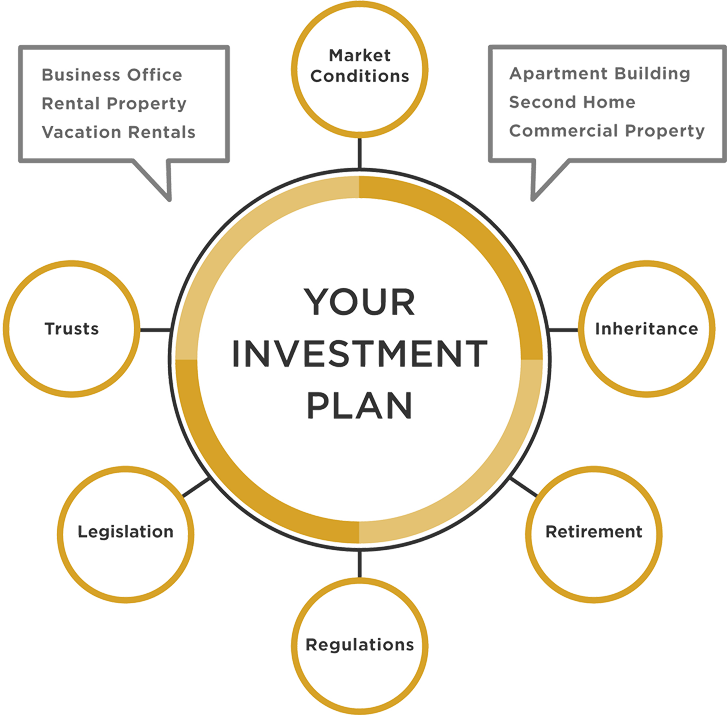

Looking to invest in Bay Area real estate? Investors— whether individuals or groups—choose us to create investment strategies that combine personal involvement with income generation, appreciation, or capital gains objectives. An investment strategy guides investors' decisions, based on their goals, risk tolerance, and future needs for capital or tax relief. Some investment strategies seek rapid growth through capital appreciation, while other strategies take a low-risk approach focusing on wealth protection.

Investment Strategies

Think of cash flow investing in the same way you think about stock dividends. With stock, you're buying a portion of a company that generates income. At some interval—monthly, quarterly, semi-annually or annually—you receive regular cash distributions from your investment. With real estate investing, you purchase a portion, or all, of an asset that can be leased to generate income. Monthly rent payments create cash flow. A cash flow surplus means net returns exceed expenses and associated costs—both carrying and fixed costs.

Investing for AppreciationAlthough cash flow is a primary consideration for investors, appreciation in value over time is also important. There are two ways in which you can build equity in a rental property: appreciation in value and paying down the mortgage. We can help you leverage your investments and grow your portfolio by using the equity in owned properties.

In 2017, Congress passed the Opportunity Zone program, which gives real estate investors additional options for reducing capital gains liability. A qualified Opportunity Fund is a U.S. partnership or corporation that intends to invest at least 90% of its holdings in Opportunity Zones—low-income areas identified across the US. These areas can now receive investment for revitalizing businesses, infrastructure, and neighborhoods from Opportunity Funds. Investors can defer and reduce capital gains taxes and eliminate taxes on potential future appreciation in Opportunity Zone investments held long term. When you work with Pertria, you can gain a significant investment advantage. Not only do we have unparalleled knowledge of the Silicon Valley market, we also reserve a team of strategic partners who provide specialized expertise. These trusted partners work discreetly with many of our clients in complex situations involving factors such as inheritances, divorce, impending IPOs, 1031 exchanges, large stock sales, and other.

Our Areas of Expertise

The Bay Area's unique market conditions and dynamics require in-depth understanding of its living costs, demographics, employment rate, supply and demand, mortgage rates and global economic impact.

InheritanceGenerational wealth transfer often includes significant tax considerations—from inheritance taxes on the beneficiary to estate taxes on the deceased's estate. Our relationships with tax experts are invaluable to clients in either case.

TrustsTrusts are valuable instruments for controlling wealth and protecting your legacy. Placing assets like real estate in a trust may save time, court fees, and reduce estate taxes.

LegislationReal estate decisions hinge on proper understanding of legal topics such as deeds, titles, purchase financing, zoning, taxes, and estate planning. We provide clients with our experience as well as contact with trusted real estate attorneys.

RetirementInvesting in real estate for retirement can yield appreciation and ongoing cash flow. We provide clients with strategies that align with their retirement goals for using real estate as a retirement asset.

RegulationsLocal, state, and federal regulations have significant impact on real estate investment decisions. We have deep visibility into existing property zoning, rent control, taxation, construction, and parking ordinances, as well as proposed regulations.